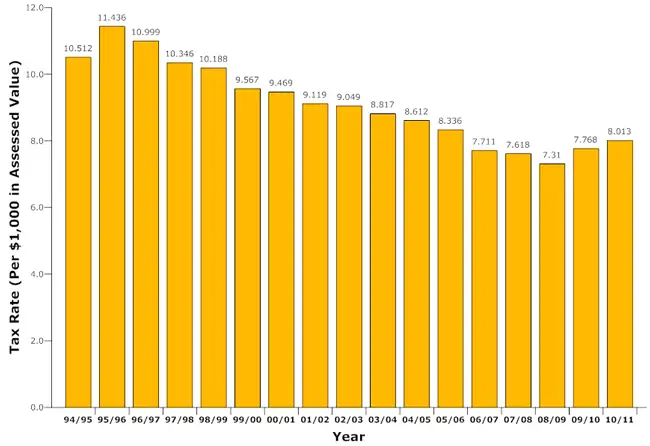

The Flagler County School Board this morning voted to approve a preliminary school property tax rate of $8.013 per $1,000 in taxable value for the coming year. The tax-rate increase is the second in two years. The current rate is $7.768 per $1,000 in taxable value. Last year, the rate was $7.31 per $1,000.

How that translates to your tax bills is as follows: a homesteaded residence valued at $150,000 will pay $1,002 in school property taxes next year, compared with $971 this year, a 3.2 percent increase. (Only half the $50,000 homestead exemption may be applied to school taxes. The only other exception is a $500 widow exemption. The effects of that exemption on property taxes is negligible.)

Overall, and despite taxable values declining 31 percent since their peak in 2008, the property tax rate for schools is still one-third below the rate of the mid-1990s, when it peaked at $11.4 per $1,000 in taxable value.

While the tax rate is increasing, many property owners will not see as significant an increase in their tax bill –indeed, some will see a decrease in their bills — because of crashing property values. The tax rate is increasing to compensate for a 13.2 percent decrease this year in property values taxable by the school board. As values decrease, there’s less to tax. To bring in the same amount of money as was brought in the previous year, the school board must raise the tax rate. The tax rate is set so as to, in the end, generate about as much revenue next year as it did the last.

Nevertheless, the local property tax rate would have been much higher had it not been for state and federal dollars compensating for diminishing local dollars.

The Flagler school district is budgeting for $159 million for the coming year. Construction funds accounts for $25 million, debt servicing for almost $10 million. Federal funds, including stimulus dollars that keep teachers employed, account for $15 million, with another $2 million in various state and local funds. The general fund–where property taxes go–adds up to $107 million. That’s the fund that pays for most of the district’s instructional and day-to-day operations.

Total per-student funding from state and local tax dollars adds up to $63.4 million for the coming year, a slight increase from the $62.2 million for the last school year. As housing values increased in the last decade, local taxes accounted for a larger and larger share of the overall cost of running the school district. In 2007, for example, local taxes accounted for 94 percent of the total dollars going to instruction and other student services. State dollars’ share fell to 6 percent. This coming year, local dollars will account for less than 70 percent, with state dollars picking up the rest. Overall, however, per-student funding is not increasing significantly.

The school district will hold its first public hearing on the coming year’s tax rate on Tuesday, July 27, at 5:15 p.m. in the district’s board chambers at the Government Services Building in Bunnell. The final budget hearing will be held on Sept. 7 at 5:15 p.m. in the same location.

dlf says

Have these people looked at the jobless rate in Flagler? I guess it is better to raise taxes in place of looking at ways to reduce spending, what a joke.

NOT OUT OF THE WOODS says

Raising taxes in a recession is not the answer and raising taxes to balance the budget should be the last option….suspend construction and make line item budget cuts….cut admin layers & have admin people teach part-time…cut before raising taxes!

Taxman says

Budget hearings, for the most part, are a ruse. The votes have been cast and unless there are protests in mass there is little opportunity for change. Flagler county has a low voter turnout so do not anticipate any sea of protest from those who disagree with another tax increase.

Does the School Board have to bring in the same amount of money as last year? Many are doing more with less. Reducing the budget would seem like a logical step.

Let’s project what the rationale will be from those who voted for the increase. “Revenues are down, we are doing all that we can, or it’s only a 3% increase”.

8mm to DVD says

First time I’ve visited your blog… good find! Thanks.