By Shahid S. Hamid

Hurricane Ian’s widespread damage is another disaster for Florida’s already shaky insurance industry. Even though home insurance rates in Florida are nearly triple the national average, insurers have been losing money. Six have failed since January 2022. Now, insured losses from Ian are estimated to exceed US$40 billion

Hurricane risk might seem like the obvious problem, but there is a more insidious driver in this financial train wreck.

Finance professor Shahid Hamid, who directs the Laboratory for Insurance at Florida International University, explained how Florida’s insurance market got this bad – and how the state’s insurer of last resort, Citizens Property Insurance, now carrying more than 1 million policies, can weather the storm.

What’s making it so hard for Florida insurers to survive?

Florida’s insurance rates have almost doubled in the past five years, yet insurance companies are still losing money for three main reasons.

One is the rising hurricane risk. Hurricanes Matthew (2016), Irma (2017) and Michael (2018) were all destructive. But a lot of Florida’s hurricane damage is from water, which is covered by the National Flood Insurance Program, rather than by private property insurance.

Another reason is that reinsurance pricing is going up – that’s insurance for insurance companies to help when claims spike.

But the biggest single reason is the “assignment of benefits” problem, involving contractors after a storm. It’s partly fraud and partly taking advantage of loose regulation and court decisions that have affected insurance companies.

It generally looks like this: Contractors will knock on doors and say they can get the homeowner a new roof. The cost of a new roof is maybe $20,000-$30,000. So, the contractor inspects the roof. Often, there isn’t really that much damage. The contractor promises to take care of everything if the homeowner assigns over their insurance benefit. The contractors can then claim whatever they want from the insurance company without needing the homeowner’s consent.

If the insurance company determines the damage wasn’t actually covered, the contractor sues.

So insurance companies are stuck either fighting the lawsuit or settling. Either way, it’s costly.

Other lawsuits may involve homeowners who don’t have flood insurance. Only about 14% of Florida homeowners pay for flood insurance, which is mostly available through the federal National Flood Insurance Program. Some without flood insurance will file damage claims with their property insurance company, arguing that wind caused the problem.

How widespread of a problem are these lawsuits?

Overall, the numbers are pretty striking.

About 9% of homeowner property claims nationwide are filed in Florida, yet 79% of lawsuits related to property claims are filed there.

The legal cost in 2019 was over $3 billion for insurance companies just fighting these lawsuits, and that’s all going to be passed on to homeowners in higher costs.

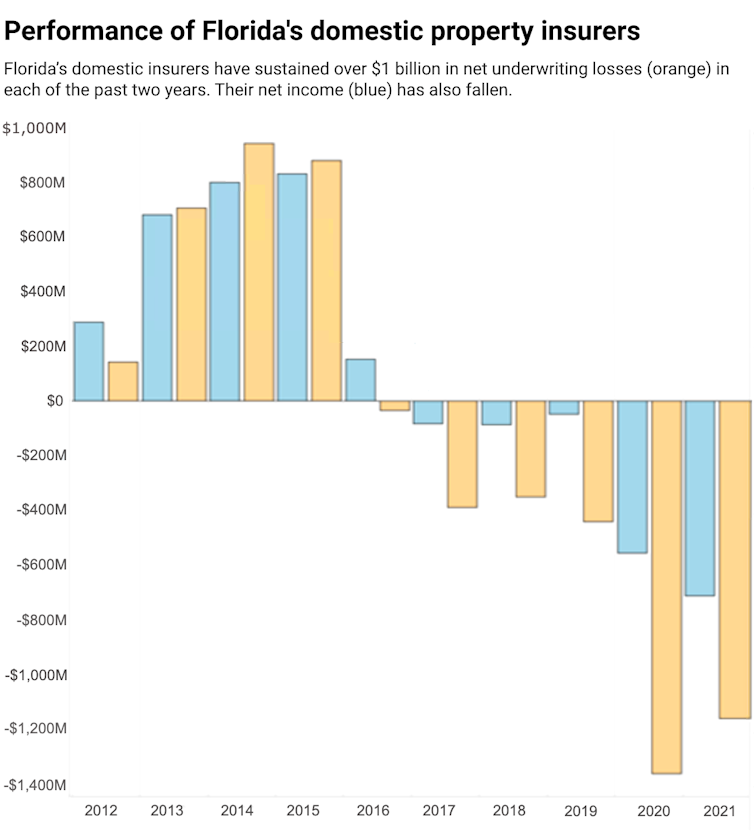

Insurance companies had a more than $1 billion underwriting loss in 2020 and again in 2021. Even with premiums going up so much, they’re still losing money in Florida because of this. And that’s part of the reason so many companies are deciding to leave.

Assignment of benefits is likely more prevalent in Florida than most other states because there is more opportunity from all the roof damage from hurricanes. The state’s regulation is also relatively weak. This may eventually be fixed by the legislature, but that takes time and groups are lobbying against change. It took a long time to pass a law saying the attorney fee has to be capped.

How bad is the situation for insurers?

We’ve seen about a dozen companies be declared insolvent or leave since early 2020. At least six dropped out this year alone.

Thirty more are on the Florida Office of Insurance Regulation’s watch list. About 17 of those are likely to be or have been downgraded from A rating, meaning they’re no longer considered to be in good financial health.

The ratings downgrades have consequences for the real estate market. To get a loan from the federal mortgage lenders Freddie Mac and Fannie Mae, you have to have insurance. But if an insurance company is downgraded to below A, Freddie Mac and Fannie Mae won’t accept it. Florida established a $2 billion reinsurance fund in May 2022 that can help smaller insurance companies in situations like this. If they get downgraded, the reinsurance can act like co-signing the loan so the mortgage lenders will accept it.

But it’s a very fragile market.

Ian could be one of the costliest hurricanes in Florida history. I’ve seen estimates of $40 billion to $60 billion in losses. I wouldn’t be surprised if some of those companies on the watch list leave after this storm. That will put more pressure on Citizens Property Insurance, the state’s insurer of last resort.

Some headlines suggest that Florida’s insurer of last resort is also in trouble. Is it really at risk, and what would that mean for residents?

Citizens is not facing collapse, per se. The problem with Citizens is that its policy numbers typically swell after a crisis because as other insurers go out of business, their policies shift to Citizens. It sells off those policies to smaller companies, then another crisis comes along and its policy numbers rise again.

Three years ago, Citizens had half a million policies. Now, it has twice that. All these insurance companies that left in the last two years, their policies have been migrated to Citizens.

Ian will be costly, but Citizens is flush with cash right now because it had a lot of premium increases and built up its reserves.

Ricardo Arduengo / AFP via Getty Images

Citizens also has a lot of backstops.

It has the Florida Hurricane Catastrophe Fund, established in the 1990s after Hurricane Andrew. It’s like reinsurance, but it’s tax-exempt so it can build reserves faster. Once a trigger is reached, Citizens can go to the catastrophe fund and get reimbursed.

More importantly, if Citizens runs out of money, it has the authority to impose a surcharge on everyone’s policies – not just its own policies, but insurance policies across Florida. It can also impose surcharges on some other types of insurance, such as life insurance and auto insurance. After Hurricane Wilma in 2005, Citizens imposed a 1% surcharge on all homeowner policies.

Those surcharges can bail Citizens out to some degree. But if payouts are in the tens of billions of dollars in losses, it will probably also get a bailout from the state.

So, I’m not as worried for Citizens. Homeowners will need help, though, especially if they’re uninsured. I expect Congress will approve some special funding, as it did in the past for hurricanes like Katrina and Sandy, to provide financial aid for residents and communities.

![]()

Shahid S. Hamid is Professor of Finance at Florida International University.

beachcomberT says

Thanks for a simplified summary of the facts. If insurance companies balk at paying claims, there will be even more lawsuits and more money going to law firms riding the Ian wave. We have a gubernatorial candidate reminiscing about how he cut insurance rates 10 percent back in the day. I think most voters are perceptive enough to recognize that political ads are raising false hopes.

Roger Ware says

I just retired from 40 years in the Property / Casualty insurance industry. Insurance carriers require capital like any business. They expect an adequate return for their investors. Most standard carrier’s stopped writing wind coverage years ago. Only Lloyds of London and a select few are still willing to insure coastal wind exposures. One storm similar to Ian can wipe out 30 years of collected premiums. People need to wake up. Fraud and aggressive attorney’s are to blame. Period. When you see a attorney commercial with a group of attorney’s walking away from a private jet, who do you thing is ultimately paying those cost? Until our legislators address fraud and keep disputes over roof claims away from attorney’s, we will continue to to see reduced capacity and increase pricing. Expert mediation and not courts work! Oh, and a message to the democratic candidate for governor who has promised to reduce rates by 10%, good luck. All you will do is drive more carriers out of Florida.

D says

Fraud is when an insurance company strips itself of cash by doling out heinous salaries, extra egregious bonuses to CEO and family members, transferring tens of millions of dollars to affiliate parent or sister companies which can no longer be used to pay claims, and then take one final stab into the company’s chest wall before declaring death by insolvency, and attempt to blame litigation, roofing scams and hurricanes, but when the truth actually sees the light of day, it was theft, pure and simple theft due to insatiable greed that doomed it all

Joe D says

June of 2022, Geico (Security First in Florida) wanted to raise my 1150 sq ft Flagler beachfront poured concrete elevated townhouse with a concrete slab roof from $2600 to $4300 because I couldn’t PROVE my roof was less than 10 years old ( after digging records and specula inspections ( $525) I was able to prove it was done in 2018, however my concrete flat slab roof REALLY doesn’t ever NEED replacing, but it took a specially trained inspector tonprove it. So I went with a different company and was able to obtain wind and roofing structural approval for 5 years (after which I’ll have to pay for new inspections all over again)

True to the inspectors reports, my townhouse survived Ian with only the hurricane cover ripped off the rooftop A/C unit… no wind damage, no flooding (first living level is 20 ft above sea level).

So now I fear, that although I was careful ($$$) to choose a property less likely to be damaged or flood, the entire State of Florida insurance premiums will skyrocket now due to the Ian damage I was luckily able to avoid. Although my heart goes out to the West Florida coast with their devastating damage, I’m now looking if I will be able to afford to stay in Florida, if the property taxes and the insurance rates continue as they have BEFORE Ian struck

Especially concerned with examples of arbitrary State Government decisions to “punish “ companies for their political stances, resulting now in a MULTIPLE millions of dollars in lost local jurisdictional (ORANGE COUNTY) tax income due to hit in local taxpayers in 2024!

James says

“… poured concrete elevated townhouse with a concrete slab roof… first living level is 20 ft above sea level… ”

This might sound kinda nuts but… why do you feel you need insurance for this property?

I guess you still carry a mortgage.

Joe D says

Bingo…yes, a mortgage! And there are other possible insurance liabilities (fire, personal injury)…I understand that Insurance Companies are not CHARITIES, but shouldn’t there be better rates, if you’ve done all the protection you can, and have the inspection to prove it)? Essentially my concrete slab roof NEVER needs replacing, but Security First wouldn’t accept it, so I got my lower discounted rate for the same $2600 I had originally from Security First. I should not be lumped into “Florida rates” given the extra money I spent to

Limit their and my liabilities, in the home design I chose. I did have multiple discounts with the new company, for the secure and safety design of my house. Now I’m REALLY fearful of the next blanket rate given the cost of Ian.

James says

It’s another little trick they play on the unsuspecting out here… I know this from personal experience. They cancel the policy for any small reason, then you’re left scrambling for coverage because the mortgage company, bank, or whoever, finds out and is going to pull your mortgage.

I guess in many cases folks just walk away from their property leaving the lender to put it back on the market. Nice little scam that works probably three out of ten times for them. Be always on guard. Everyone has some kind of racket going on out here.

Kip says

My rate was 1500 last year, this year is 4500! I will be selling head back west.

Leila says

It would be hard not to notice the amount of new roofing going on here. Insurance companies don’t seem to care how old your roof is, they want it replaced or they threaten to cancel you. They leave little choice. It is becoming an issue with homes for sale. It isn’t going to matter what state you live in if the state legislatures refuse to do anything about this. People are being priced out of their homes.

Joe D says

Apparently insurance companies don’t want your roof to be over 10 years old, even if you paid extra for a 20-30 year guaranteed roof ?!?

jim lang says

This how everyone in my neighbor got a new roof last year. Including myself. :)

Uncle Albert says

Im going to build a Dome House that can also be used as a submarine in case it gets washed out to sea.

I’m naming it ” The Blue Sardine “.

J. Michael Kelley says

Professor Hamid has stated the Homeowners Insurance cost in Florida very well. If a contractor asks you to sign the aforementioned they usually already have an Attorney waiting in the wings. Your insurance Company has to deal with the contractor you gave your rights to. When they are sued they have two options. 1)Settle out of Court. 2) Try to defend. Unfortunately they lose either way, because even when they win the suit they cannot get their Attorney Costs back. Our system needs to change to “Winning Party Prevails”, which means whoever loses the suit pays both parties Attorneys. That would stop a lot of the nonsensical law suits from being filed. Lastly, as a retired Independent Insurance Agent, NEVER SIGN AN ASSIGNMENT OF BENFITS AGREEMENT. Find a different contractor who won’t steal your rights from you.

TeddyBallGame says

I recall, 12 plus years ago, that you could wave hurricane (named storm) coverages, has that change?

This is what I will do. No mortgage, 5 old archectual (sp) shingles roof.